About Fillableformw9.com

Fillableformw9.com helps you to create, fill out, download & print/mail your Form W-9 easily in minutes. With our Cloud-based software, You can access your W-9 Form from anywhere at any time. Our simple instructions guide you to fill out W-9 Online easily and securely. We also perform validation for identifying basic errors on the W-9 Form.

You can also edit the W9 fillable pdf if you have any corrections. After submitting the form to the requester, you can fix the errors and re-submit it to them. By using our application for filling W9 forms you can e-sign and email your form directly to the recipients.

By using our application for

filling W9 forms you can e-sign and email your form directly to the recipients.

Steps to fill out W9 Online by using Fillableformw9.com

Download and print/share Form W-9

share your completed W-9 with the payers by email (or) download your W-9 Form pdf Print it, and deliver a copy

to them.

Why choose Fillableformw9.com to create and fill out W9 Online?

Create, Fill, & complete your

Form anytime

Validate Forms for identify

basic errors

Download Form W9 as PDF or

Print your Form

Edit or Correct Details

at any time

Download & Print completed

copy for FREE

Share your Form W-9 with

unlimited payers

If you are a payer, Request Form W-9 from your vendors with TaxBandits

You can use our Form W-9 Manager to request, collect, and securely manage the W-9/W-8 forms of your contractors in

one place.

- Ensures accuracy using TIN Matching.

- Import data from Xero, QuickBooks, ZohoBooks, and FreshBooks.

- Supports Bulk requests for W-9s.

- Get real-time status updates

Suppose you are a business that is obliged to make payments (usually in excess of $600) to any individual or entity for services done, such as independent contractors, freelancers, or consultants. In that case, you must request Form W-9 from the payee.

A W-9 form ensures you have the essential information to properly file 1099 forms with the IRS at the end of

the year.

Frequently Asked Questions on Fillable Form W-9

Q

What is the purpose of Form W-9?

The W-9 form is an IRS tax form that is filled out by individual contractors or businesses to provide their taxpayer identification number (TIN) and submitted to the person who employs them.

An individual that employs contractors uses the TIN to file Form 1099-NEC to the IRS at the end of the year. This form reports the amount of income that was paid to the

contractor or freelancer.

Learn how to request Form W-9 Online.

Q

Who must complete W-9?

The Form W-9 should be completed by an individual, when it is requested by a business (payer) or financial institution that will be required to file a 1099 form for them at the end of the year, reporting payments made. Some examples of these payments include:

- Income paid to the vendors

- Real estate Transactions

- Mortgage interest you paid

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions you made to an IRA

Q

What is the information required to fill out W9 Online?

The basic information required to fill out W9 Online is:

- Name

- Address

- Tax Identification Number(TIN)

Get to know the detailed information to complete Form W-9 by visiting, https://www.taxbandits.com/what-is-form-w9/

Q

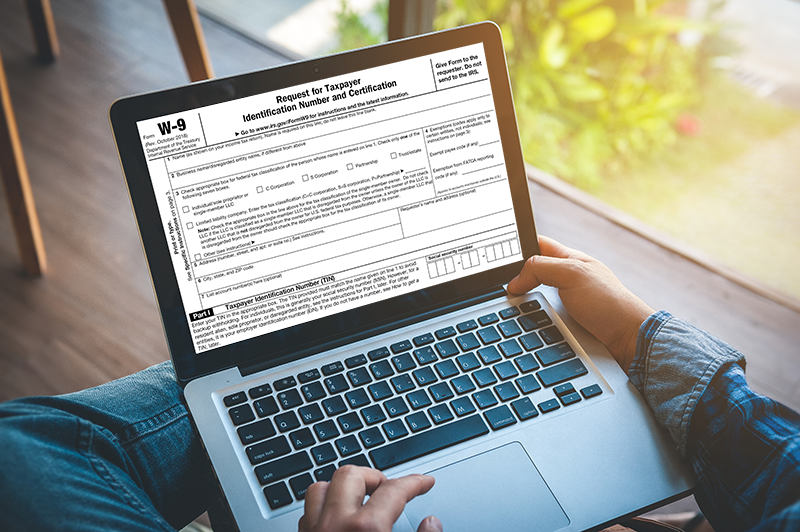

How to fill out W-9 Online?

Fill out W-9 Online and submit to the payer that has requested it.

- Line 1 - Name

- Line 2 - Business name.

- Line 3 - Federal Tax Classification - Based on your business type

- Line 4 - Enter the required codes on the appropriate line, if you are exempted from

Backup withholding & FATCA Reporting - Line 5 & 6 - Address, city, state, and

ZIP code. - Line 7 - Account number

- Part I -Taxpayer Identification

Number (TIN) - Part II - Certification - signature

and date.

Visit, https://www.taxbandits.com/fillable-form-w9/ and make your process of filling W-9 Form easy and simple.

Helpful Resources

What is Form

W-9?

.png)

Fillable W9

Backup Withholding